CreditVerse: The Next Generation of Low-Code Digital Lending for the MENA Region

Launch Lending Products in Weeks, Not

Months.

In today’s competitive financial landscape, agility defines leadership. Legacy systems are slow, expensive, and inflexible—holding institutions back from seizing new opportunities. CreditVerse changes that

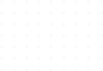

Built as a low-code, API-first platform, CreditVerse empowers banks, NBFCs, and dealer networks to configure and launch new loan products in weeks instead of months. From onboarding to servicing, it provides a single, unified ecosystem that delivers speed, transparency, and intelligence across every lending journey

CreditVerse: From Idea to Market—Smarter, Faster, Stronger

⚡ Faster Time-to-Market: Launch retail, SME, and auto loans in weeks, not months

🧠 AI-Powered Decisioning: Instant affordability and credit checks

🤝 Dealer & Partner Portals: Submit, track, and close loans seamlessly

📱 Omnichannel Experience: Branch, tablet, mobile, or web—always connected

📊 Analytics & Insights: Leverage real-time dashboards to monitor performance, identify risks, and uncover cross-sell/upsell opportunities

🔗 Seamless Integrations: Pre-built adapters for CRM, credit bureaus, and Open Banking APIs—no need for costly system overhauls

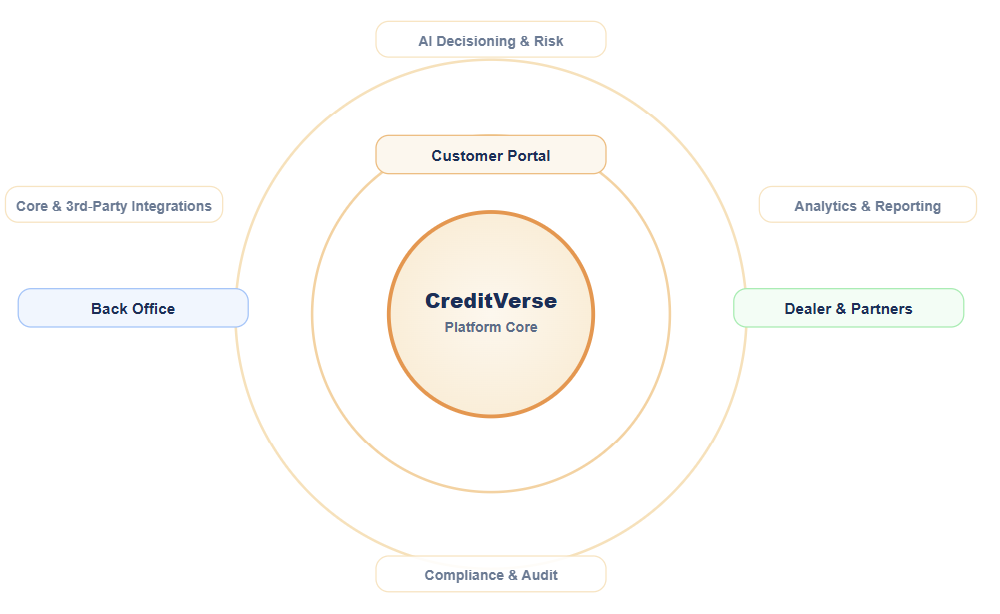

Loan Origination

• Using Loan Calculator to select the amount and duration of the loan to instantly find out the monthly installment amount

• Pre-approved offers for simple, hassle-free and fast loan applications

• Ensuring a personalized customer journey with Next Best Offer

Application and Data Capturing

• Online application: offering a fully-digital, customer-driven lending experience

• Customer identification: complying with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations

• Document checklist: handling large volumes of loan documents swiftly and accurately with Intelligent Document Processing technology

• Digital verification for proof of customer (income and repayment capability)

Loan Processing

• Using BusinessNext CRM capabilities to define a list of pre-approved automated loan checks

• Swift decision-making processes to facilitate pre-approved offers and instant loan approvals

• Connecting to multiple credit checking organizations

Underwriting

• Integrating eligibility calculator to reduce acquisition costs

• Approval in principle for customers with limited data

Loan Approval

• Digitizing confirmation process to onboard the new customer

• Robust decisioning engine for fast decisions and instant disbursement

Disbursement

• Simplifying loan applications with digital signature workflow

• Handling documents digitally from template automation to printing, document scanning to archiving

👉 CreditVerse turns lending into a customer-first experience, building trust while accelerating growth.